University Government Borrowing from the bank Commitment (UFCU) is actually dependent almost 100 years ago by a small grouping of College or university away from Texas professors having a provided sight and you can a collective put regarding $873. Today simple fact is that 8th biggest financial co-op from the county, that have assets exceeding $6.nine billion. But also for UFCU, its most readily useful house ‘s the 320,000+ members one buy its achievements.

UFCU’s dedication to getting an amazing associate feel have not gone unnoticed. It seem to looks from inside the best of lists-together with Forbes’ annual better-in-condition listing, hence knows the top borrowing unions around the world.

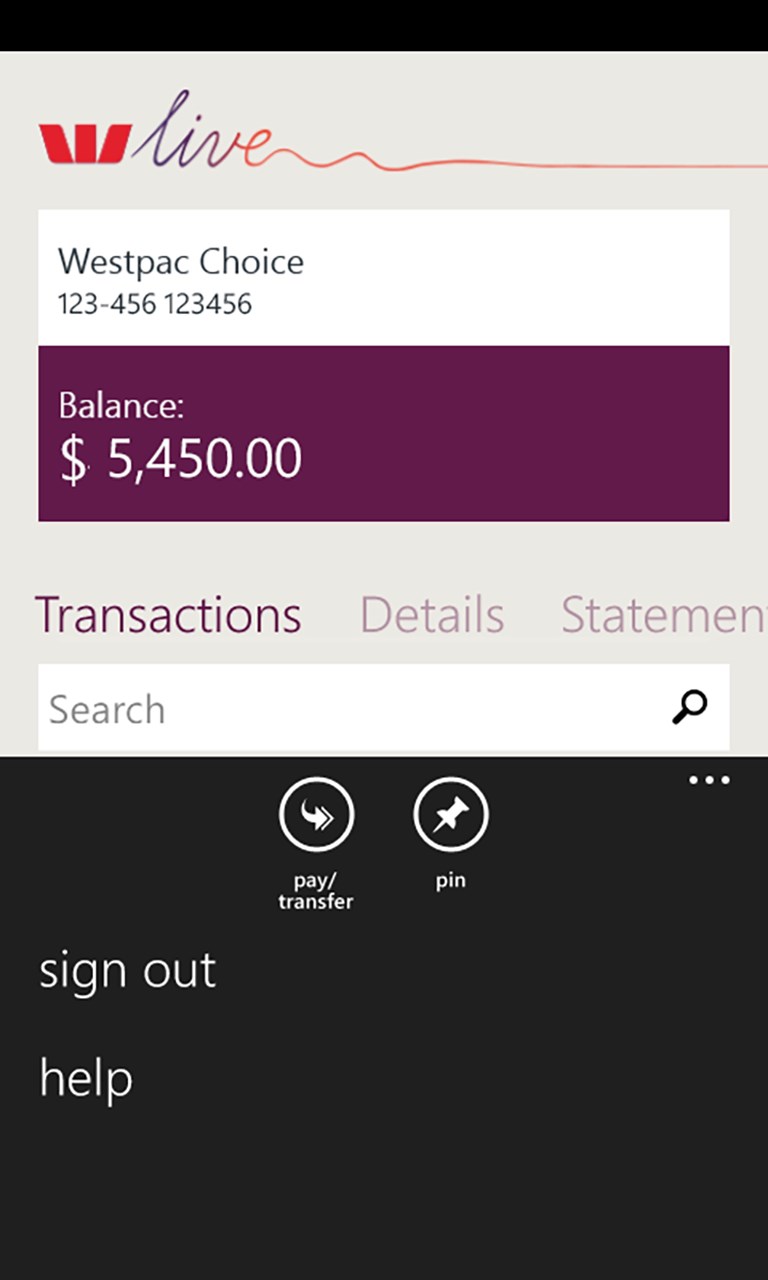

Our company is very trying see our members’ need and apply at him or her from inside the meaningful ways that incorporate well worth, told you Mike Irwin, Movie director of Associate Sense. Extensive look revealed players require 24/eight features. Filled with ensuring arrangement techniques that will be fast, basic safer. Playing with DocuSign eSignature and you can Directed Forms, UFCU not simply became stronger matchmaking having players; the lending regularity increased, as well.

Appointment professionals in which he is

Over the course of his almost 18 many years during the UFCU, Mike Irwin features added the credit partnership compliment of several conversion initiatives, in addition to putting some relocate to paperless mortgage techniques. UFCU’s ten years-much time reference to DocuSign first started with dodged calls when you find yourself the financing union was a student in the midst of using a different mortgage origination system.

I sooner or later found the telephone, therefore really was a pivotal time for our credit operations, said Irwin. In personal loans that use good credit and not incom advance of, people was required to print-out the borrowed funds files, indication her or him, get a hold of good fax machine and you may posting these to the financing relationship. It sounds thus silly after you consider this today-it was state-of-the-art, ineffective and set us up to have problems. Automobile financing suffered because are more comfortable for players commit which have dealer funding versus faxing documents into the versions, waiting for recognition and you will picking up a magazine evaluate while in the UFCU’s regular business hours.

Now, DocuSign try totally incorporated with Temenos Infinity to streamline an individual credit experience constantly. Since the procedure is digitized, players can put on for a financial loan and get a choice inside the moments. Mortgage documents is actually instantly made courtesy Temenos and you will routed toward correct anybody to possess e-trademark.

Once revamping its loan processes, working can cost you transpired and you will auto loans ran up. Immediately following investment is eligible, UFCU users are emailed a relationship to a digital car buyer’s see (eVBC) that is as nice as bucks regarding dealer’s position. Dealers and you can professionals may go online, prove vehicle and you may prices pointers and electronically signal the brand new document in order to start the money disbursement via ACH. The credit union-made the action a lot more member-amicable for everyone playing with DocuSign Led Versions. Rather than needing to case away from package in order to container when you look at the a keen e-function, they have been led through an interactive process.

DocuSign was intertwined throughout UFCU

What began in order to streamline individual lending process developed to help you account opening, registration notes, Time, Home business Government (SBA) credit and. You will find depend on about provider and you can consistently find even more use circumstances, told you Irwin. In the event that pandemic hit, the credit union failed to forget about an overcome. I lucked away with DocuSign currently in position-so, when professionals started working from home, it absolutely was nearly a low-experience.

UFCU works together countless dealers, but DocuSign is considered the most all of our longest relationships. You to speaks amounts of one’s device while the partnership i’ve.

As the brief companies got a huge strike into the COVID-19 crisis, UFCU helped nearly 1,200 regional entrepreneurs promote financial defense for over cuatro,100 professionals-which have Paycheck Safeguards Program (PPP) finance totalling next to $34 million. The financing partnership released a different sort of standalone mortgage origination program which is specifically designed getting PPP-possesses an immediate combination which have DocuSign-locate finance so you can players as soon as possible.

COVID has had an impact on route we jobs, additional Kaylyn Leese, Director off Credit Systems. UFCU try consistently considering the newest making use of DocuSign to top suffice their user community electronically. It’s been a beneficial partnership-the one that we have been persisted to grow once we move forward.