The fresh new digitization and you may opening off financial structure features designated an in the past and an afterwards throughout the monetary globe. Financial branches features provided means to fix an online offer and you may functional model, in which actual presence has stopped being since the needed. Open banking went a step subsequent, giving usage of third parties making sure that all the banking businesses and you will deals are complete off their electronic platforms, so long as he’s got the fresh new associated authorization and you can approve the coverage.

Mortgages, the new core providers of many finance companies, haven’t stayed untouched through this the brand new truth. Regarding majority out-of instances, it is still very important to consumers to consult with this new part physically to help you negotiate this new loan’s terms and conditions. However, this form of closure deals appears to be on their way out, since financial APIs seek to speed up the process to possess applying having and you can giving eg finance.

The conventional home loan app: a slow, paper-hefty procedure

The loan business have experienced an unmatched transformation for the past ten years, since the introduction of this new subprime financial crisis inside the 2008. Subsequently, and in acquisition to prevent the brand new terrible consequences of the bust construction ripple in the us and you may The country of spain, various other regulations was in fact passed to safeguard customers.

Creditors experienced in order to adjust their processes to fit it the brand new legislative construction, that have stricter conditions having granting a mortgage: it is important so you’re able to appraise the home obtainable, to transmit most of the files certifying the fresh new applicant’s solvency, to have the lender accept they considering the risk government and you will head to a notary public, utilizing the resulting costs.

Complete, the loan financing initiation procedure takes ten to fifteen weeks to the average, even though there isn’t any lawfully set period. The fresh new Language mortgage laws, and that inserted on push for the , possess lengthened such due dates even further and, in some cases, they may go beyond a 30-date several months.

Open financial because a stimulant with the home loan field trend

Given the mortgage market’s special features, making an application for and granting a home loan is just one of the pair financial processes you to definitely nevertheless requires the real visibility of users at the a financial branch. However, open financial and you will APIs could be the ultimate catalyst having beginning yet another path getting automation.

In fact, with regards to the current IRESS Intermediary Home loan Questionnaire 2019, 96% of participants point out that unlock banking as a whole, and also the standardization regarding API include in variety of, is very effective after you sign up for a home loan. Generally speaking, profiles accept that this particular technology often provide much warmer entry to financial customers which help speeds the entire process of trying to get and you may giving mortgage loans.

A serious reduced papers

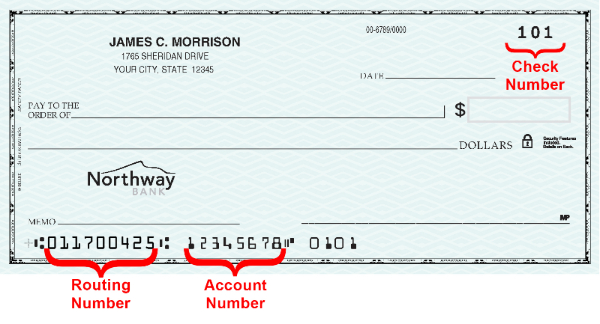

For the app to possess a home loan, a branch manager requests a series of data from their consumer. The client, subsequently, need certainly to collect all the information, prove that this documentation is actually acquisition and posting they to help you the lending company; the bank upcoming work brand new involved exposure manage and you may approves/denies the program.

Having APIs, this action would be notably basic. Brand new biometric identification points keeps changed the way which files try exhibited; something, up until now, looked unchangeable. Coupled with the reality that, for this reason open system, banking companies and other fintech organizations have access to study into customer solvency inside the a nimble and simple method, and always using their agree, many of these facts rather reduce the documents and big date allocated to granting and you will giving these money.

Simpler to meet regulatory criteria

For the e for the force. They illustrated a primary regulating changes and you will pushed organizations in order to adapt to the fresh judge conditions. This new code influenced the whole processes, out-of signing to help you canceling the loan loan, offering greater coverage so you can people and openness within the deals.

This adaptation has had loads of relevant will cost you, and the majority of dilemma for both organizations (just how to to improve its providers and you may systems on the the new control) as well as for users, who usually have no idea of its liberties in this new law.

APIs can be used to effortlessly adjust certain procedure in order to posting or access additional information prior to the fresh court criteria, and to offer they demonstrably with pure visibility to people. Such software can run more employment in order that the actions meet with the requested requirements.

An entire experience to possess customers

Mortgage loans is arguably many complicated-to-see financial product found in the profile of goods of every institution’s commercial system. Several factors and you will variables are involved: Euribor, the fresh French amortization program, the new Apr, the fresh new associated charges and you can earnings, the latest connected products…

Used, information a few of these conditions takes time, particularly when we talk about some thing as essential as purchasing an effective home. This is exactly why an enthusiastic API can help customers come across related advice about their home loan. In fact, APIs help incorporate a simulator in which customers is also read ahead, rapidly and you will 100% on line, factual statements about their mortgage’s payments, charge and you will profits, the fresh new amortization strategy, and you may what the results are in the event the Euribor increases or off.

This contributes to greater client satisfaction and you will a separate experience you to definitely grows and you may boosts the capability to choose, whilst expanding their satisfaction towards look techniques.

Good have fun with situation: BBVA’s Mortgage loans API

BBVA’s Mortgages API makes you provide your potential customers the desired money into purchase of their residence otherwise obtaining to have exchangeability without the need to get off their app. For this reason API, the newest business procedure is possible from the home away from the near future customer or from your own place of work, without having to check out a https://paydayloancolorado.net/salida/ bank department and you will handle all of the this new paperwork really.

As well as, before applying due to their mortgage, pages should be able to see extremely important economic data, like the minimum amount wanted to pertain, and replicate other conditions and watch their money for the whole financing cost period.

In a nutshell, making use of a keen API including BBVA Mortgage loans makes you feature an entire ecosystem necessary to imitate a home loan with their relevant costs towards the a bona fide property system or other system, see all the its details, find out if you can access they and you will proceed to sign up because of it right from one software. All of the with visibility and you can as opposed to rubbing of any kind.