The borrowed funds Calculator assists guess the fresh new payment per month owed along with almost every other monetary expenses associated with mortgage loans. You’ll find choices to is most costs otherwise annual percentage develops from well-known mortgage-relevant expenditures. New calculator is usually intended for use of the You.S. customers.

Mortgages

A mortgage is actually financing secure by property, always real-estate. Loan providers define it the cash lent to fund real home. Really, the financial institution assists the buyer afford the supplier from property, and also the consumer agrees to repay the bucks lent over an effective time period, constantly 15 or 3 decades on U.S. Monthly, a repayment is composed of consumer to bank. A portion of the payment per month is called the main, the amazing loan amount. One other portion is the appeal, the rates paid off on the bank for making use of new currency. There is certainly an escrow membership in it to cover the pricing out-of assets fees and payday loan Leroy you can insurance rates. The consumer can’t be felt an entire owner of your own mortgaged assets till the last monthly payment is created. From the U.S., the most popular home loan ‘s the antique 29-seasons repaired-notice loan, which is short for 70% to ninety% of the many mortgage loans. Mortgages are exactly how most people are in a position to individual homes for the brand new You.S.

Financial Calculator Section

- Amount borrowed-the quantity borrowed out of a loan provider or financial. From inside the home financing, which numbers towards cost minus people down payment. The utmost amount borrowed one can possibly use generally speaking correlates with family earnings or cost. In order to estimate an inexpensive count, please explore the house Cost Calculator.

- Deposit-this new initial fee of one’s pick, always a share of the total price. This is the portion of the price protected by the borrower. Generally speaking, mortgage lenders need this new borrower to put 20% or more just like the a downpayment. Sometimes, individuals will get lay out only step 3%. If for example the individuals make a deposit away from less than 20%, they’ll be necessary to shell out personal mortgage insurance (PMI). Consumers need to keep this insurance rates before the loan’s left dominating fell less than 80% of your residence’s new price. A standard rule-of-flash is that the large the fresh new downpayment, the greater amount of positive the speed as well as the apt to be the latest financing was approved.

- Loan term-enough time over that your mortgage have to be paid back completely. Most repaired-price mortgages is actually having 15, 20, or 31-season terms and conditions. A smaller several months, particularly fifteen or 20 years, generally includes a lowered interest rate.

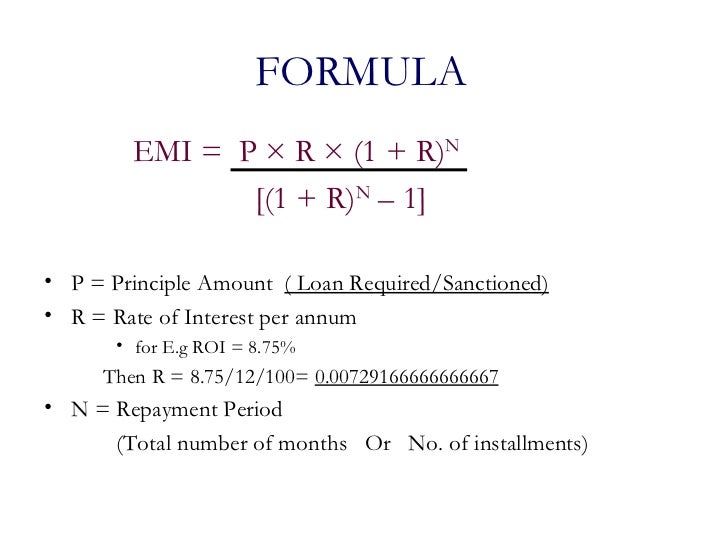

- Rate of interest-the new percentage of the borrowed funds recharged given that an installment out-of borrowing. Mortgages can charge both repaired-speed mortgages (FRM) or changeable-rate mortgage loans (ARM). Given that term ways, rates of interest will still be a similar toward identity of your own FRM financing. The latest calculator a lot more than computes fixed cost only. For Arms, rates of interest are generally fixed getting a time, following they are periodically modified according to field indicator. Fingers transfer part of the risk so you’re able to borrowers. Hence, the first interest rates are usually 0.5% to help you 2% below FRM with the same mortgage title. Home loan rates are typically expressed into the Annual percentage rate (APR), either named affordable Apr or active Apr. This is the rate of interest indicated because the an occasional price increased from the number of compounding symptoms during the per year. Particularly, when the home financing price is 6% Apr, it means the fresh borrower would have to spend 6% split up of the 12, that comes over to 0.5% within the notice every month.

Month-to-month mortgage repayments usually were the majority of this new monetary costs associated with purchasing a house, however, there are many more ample will set you back to remember. These prices are sectioned off into a couple categories, repeated and you will non-continual.