One of many trick requirements so you’re able to qualify for a residential mortgage loan is always to let you know a-two-12 months work early in the day functions records. This might be difficulty to possess current college students otherwise highest university students which only finished from highschool, college or university, or technology college or university. Of many full-big date pupils had no performs history if you’re understanding regular. Might have acquired capital through bodies college loans relatives, otherwise weird and you will stop short-term perform. Some college students, particularly legislation college or university and you can medical college or university graduates was out of work for more than 7 otherwise 8 age and you can was in fact professional children.

HUD Mortgage Direction With the FHA Fund Having Holes In Employment

Other people took time off functions and you will decided to go to university full time for you to see an alternative trade including the pursuing the:

- Vehicle mechanics

- Dental technicians

- Nursing pupils

- Police/Firefighters

- Or any other new community

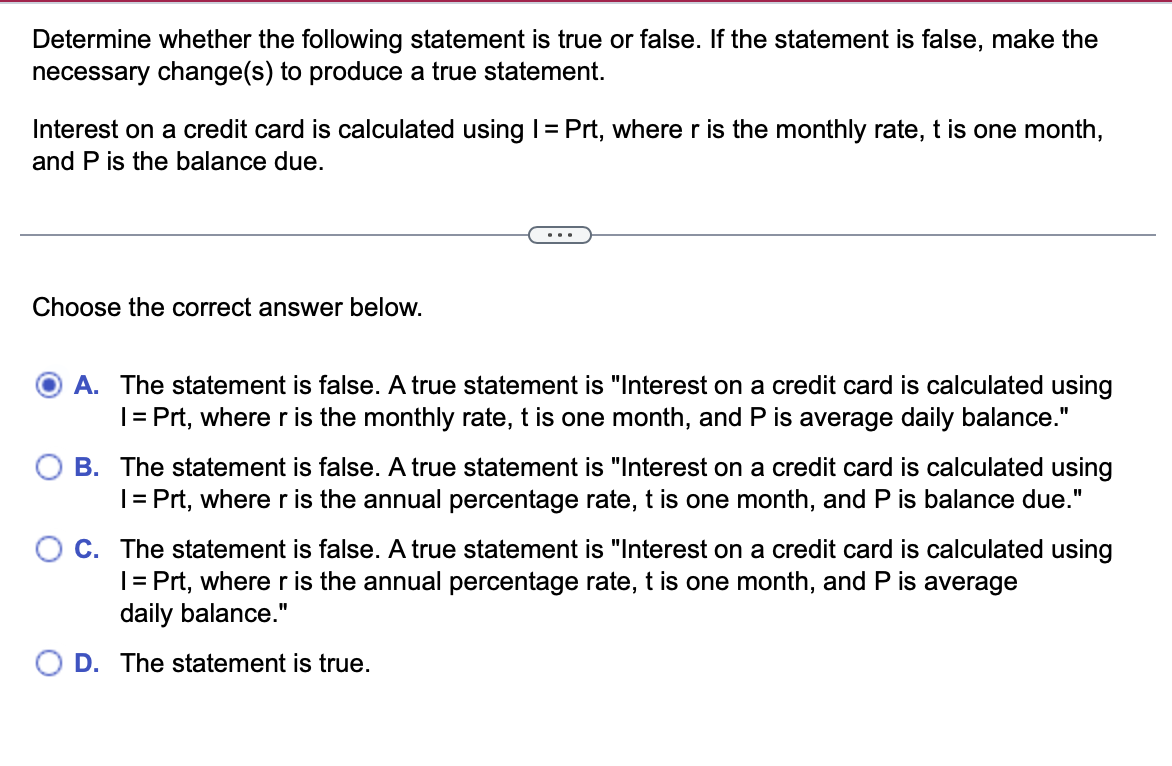

FHA Assistance To possess University Graduates Which have Changes Off World of Performs

When someone transform the world of performs, they normally need to take time away and you may see college or university for degree. Particularly, an effective beautician needs more 2,000 occasions from schooling are qualified to receive degree. Same that have police officers and you may firefighters in which they require at the least 480 or more hours regarding schooling and thus 4-6 months off full-time studies/education just before entering their new employees. Of numerous full-big date youngsters property great-paying perform within field of knowledge just after graduation. Unfortuitously, of a lot graduates have no work history, no centered credit history. Particular dont have credit scores. I have many phone calls of present college or university students who simply started another occupations inside their community. It inquire me personally once they can put on to own a residential financial financing because they do not wish Montana payday loan regulations to be a renter. The great reports would be the fact I will let previous students with no earlier really works records, zero credit tradelines, no credit scores.

FHA Guidance Getting College Graduates Having Zero Really works Sense

Homebuyers who possess merely finished out of high school, college or technical college or university and just have no functions background that they can file normally qualify for FHA Fund. The united states Department of Property And you can Metropolitan Advancement (HUD), the father or mother of your own Government Houses Management (FHA), considers full-big date schooling exactly like functions sense.

FHA Guidelines To own College or university Graduates: Regular Education Matches A couple of-Years Employment Records

You can expect home loan software for college graduates. Providing you provide evidence you are working fulltime on the arena of study, full-big date degree records can be utilized exactly like performs background. I usually mediocre the previous two years off tax statements or W2 income getting income degree. But just like the complete-go out college students don’t possess earlier getting histories, we’re going to come-off by their complete-date work render page and more than current paycheck stub. We’re going to probably require 30 days paycheck stubs. Along with verification regarding a job from borrower’s most recent workplace having them county that they’re working full time and certainly will continue to do very. The chances of proceeded complete-go out employment for the next three years becomes necessary. School transcripts will be required and you may found in lieu of your own past two years of a job background.

What about In the event the Latest College Graduate Doesn’t have Credit Or Dependent Borrowing from the bank Tradelines

We could create an exclusion if for example the present university graduate do not have a credit score or no founded borrowing from the bank tradelines having our real estate loan programs to own present graduates.

- Insurance rates commission

- University university fees fee

- Cellphone debts

- Electricity repayments

Playing with Low-Old-fashioned Credit Versus Conventional Borrowing from the bank Tradelines To own Individuals No Borrowing from the bank Scores

Of numerous complete-date people don’t have any conventional borrowing from the bank tradelines. Hence, many present college students haven’t any credit ratings. HUD, the new mother away from FHA, lets borrowers to utilize non-traditional borrowing tradelines to own consumers and no credit scores. Non-antique credit tradelines was creditors that do not report to this new around three credit reporting agencies. Examples of non-antique borrowing from the bank tradelines are resources, cellular telephone providers, book costs, university fees, dorm repayments, insurance, scientific, academic costs, or any other loan providers maybe not revealing so you’re able to credit agencies. To become considered good tradeline, the latest debtor should have been paying on the non-old-fashioned credit for the past one year.

Ways to get A credit score Having Consumers As opposed to A credit Rating

Anyone who has zero fico scores due to shortage of credit can merely get a credit rating by getting two protected credit cards otherwise incorporating themselves to their mother or father credit cards once the a 3rd party affiliate: