Utilize the obligations-to-money proportion computation described a lot more than. Whether your DTI try 25% otherwise straight down that have both the potential financial and private financing costs felt, then mortgage lender can be happy to disregard the unorthodox form of your own deposit https://paydayloansconnecticut.com/cheshire-village/.

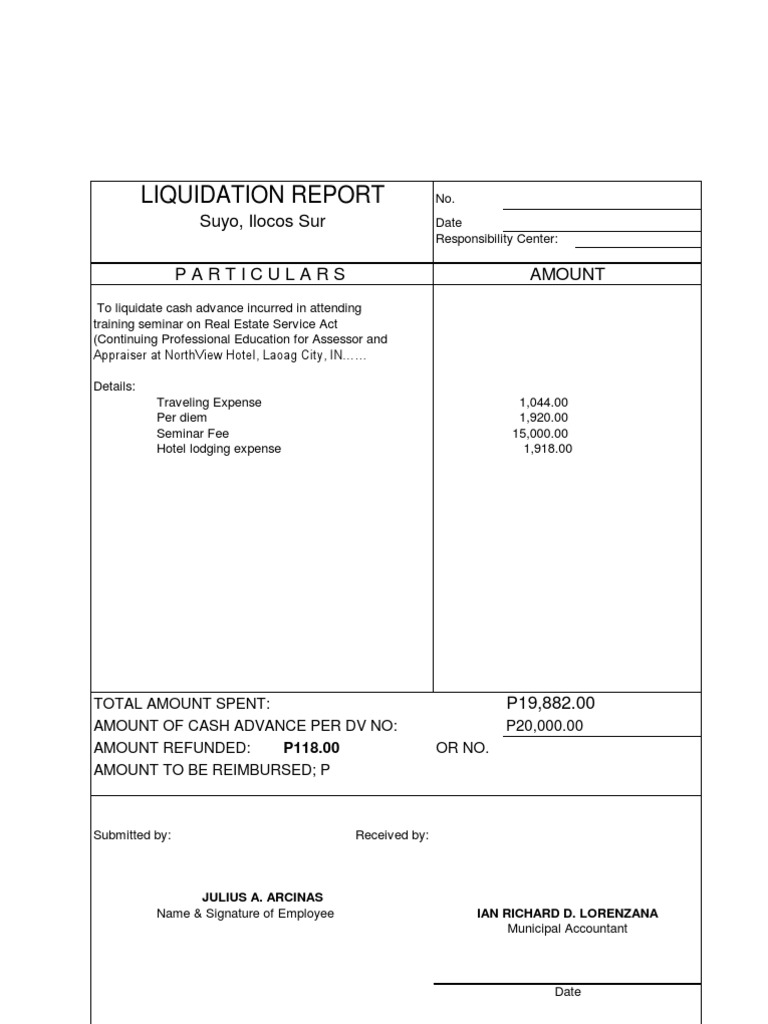

Example #1:

Tim produces ?fifty,000 yearly, their partner, Susan, brings in ?62,000. The mutual income provides a disgusting monthly earnings out of ?nine,333.

The cost of the personal debt outgoings per month, that have home loan and you will put loan is actually: ?2,850. Considering its income, that’s an effective DTI from 30.5%. Even with its big income, lenders will be probably so you can refute its application into the like that.

In the event that Tim and you can Susan spared due to their put, rather than finance they that have an unsecured loan, or if it reduced its almost every other debts and outgoings, they’d stay a much better danger of achievements along with their mortgage application.

Analogy #2:

He is finding home financing having money away from ?650 monthly and has zero coupons, so is looking for an unsecured loan to cover the deposit.

Their full outgoings to your financing, their bank card, together with home loan was ?1,010. This is certainly a great DTI off %, which would be considered lowest sufficient from the particular lenders so you can accept the loan, despite the mortgage providing the entire deposit.

Coupons and you may funds

With the debt when obtaining a home loan is not a wise decision, whether or not that is which have credit cards, overdrafts, otherwise personal loans.

About mortgage lender’s angle, it is sometimes complicated to help you validate the idea of with spared to have a deposit, and have outstanding consumer debt.

Even though it elizabeth due to the fact taking out fully a personal loan to fund a deposit, when you have tall deals to put because the a down-payment towards your brand new home however is actually counting on loans and you may borrowing from the bank various other areas of yourself, then it is comparable basically to having a loan into the deposit.

In almost all times, it is prudent to settle most of the current obligations along with your savings just before putting it towards your deposit, to ensure when you’re submit along with your mortgage software your are 100% financial obligation totally free.

It can save you inside notice also! Rates of interest towards fund will always be greater than people youre wearing together with your offers. When you are searching 1.5% per year on your savings, however, spending seven% to your an unsecured loan, it is not doing you one monetary good to hold the brand new family savings.

To own very first time buyers, who happen to be typically playing with a funds deposit, its never a smart idea to enter into a mortgage software having a great obligations if it’s you’ll to pay off the debt.

Of these swinging from a single possessions to another, likely to utilise the brand new security within their most recent home as a beneficial put to the flow, the problem is a little more challenging. As the finance commonly offered, this isn’t unlikely that there’s personal debt at the same time to the present financial. During these products, however, the principle continues to be an identical, as well as the freed security which comes from the household purchases should clearly end up being earmarked to repay the borrowing of all sorts to let a financial obligation-100 % free move into the newest property.

Pupil debt

Lasting pupil obligations is independent off faster name unsecured obligations, and there is never ever stress regarding a home loan company to pay off beginner obligations prior to a mortgage app.

Protected debt

Other secured personal debt, such as car loan, was taken into account in almost any financial obligation-to-earnings proportion calculations, but there is zero presumption to blow it off earlier to creating a mortgage application.